If you pay yearly and also have no installation or various other charges, you separate your annual premium by 12. To determine what your month-to-month prices would be with our example costs, you can utilize this formula: ($1,200-$100)/ 12 = $91. 66. (Annual premium-discount)/ twelve month = monthly rate, Your monthly cars and truck insurance coverage expense, if paying in full ahead of time, would be $91.

Among the largest aspects for customers wanting to get cars and truck insurance coverage is the rate. Not only do costs vary from firm to business, but insurance prices from state to state differ. According to , the average yearly expense of vehicle insurance in the United States was $1,633 in 2021 as well as is predicted to be $1,706 in 2022.

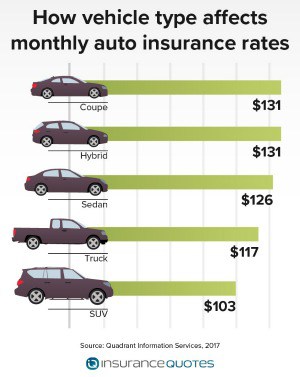

Average prices differ extensively from state to state. Insurance rates are based on multiple criteria, consisting of age, driving background, credit rating, the amount of miles you drive annually, lorry kind, and also a lot more. Depending on average cars and truck insurance costs to estimate your automobile insurance premium may not be one of the most precise method to identify what you'll pay. cheaper car.

, as well as you may pay even more or much less than the typical vehicle driver for insurance coverage based on your risk account - automobile. You'll also pay even more if you have an at-fault crash, multiple speeding tickets, or a DUI on your driving document.

It might not provide adequate protection if you're in a crash or your vehicle is damaged by another covered incident. Curious concerning how the ordinary cost for minimum insurance coverage stacks up against the expense of full insurance coverage?

An Unbiased View of How Much Does Car Insurance Cost By State? - Progressive

Yet the only way to know specifically how much you'll pay is to search and get quotes from insurance firms. One of the variables insurance companies use to establish prices is place. Individuals that stay in areas with higher burglary prices, crashes, and all-natural catastrophes normally pay even more for insurance - vehicle insurance. And also considering that insurance policy legislations and minimal coverage needs differ from state to state, states with greater minimum demands commonly have greater average insurance expenses.

Most however not all states allow insurance policy business to make use of credit report when establishing rates - affordable auto insurance. Generally, candidates with lower ratings are more most likely to sue, so they typically pay a lot more for insurance policy than vehicle drivers with higher credit report - cars. If your driving document consists of crashes, speeding up tickets, DUIs, or various other offenses, expect to pay a higher premium.

Motorists under the age of 25 pay greater prices due to their absence of experience and also increased mishap threat. The void shrinks as they age, and also ladies may pay slightly more as they obtain older.

credit score car insurance cheap car car

credit score car insurance cheap car car

Since insurance companies tend to pay more cases in high-risk areas, rates are normally greater. Getting married commonly causes reduced insurance costs. Obtaining sufficient insurance coverage might not be cheap, yet there are means to obtain a discount rate on your auto insurance coverage. Below are five typical discounts you might receive.

If you possess your residence instead of renting it, some insurance providers will certainly give you a discount rate on your vehicle insurance coverage premium, even if your house is guaranteed through another business. low-cost auto insurance. Aside From New Hampshire as well as Virginia, every state in the nation calls for drivers to preserve a minimum quantity of obligation insurance coverage to drive legitimately (business insurance).

Getting The Average Cost Of Car Insurance In 2021 - The Zebra To Work

It may be appealing to stick to the minimum limits your state calls for to save money on your premium, yet you could be placing yourself in jeopardy - insurance. State minimums are notoriously reduced and also can leave you without adequate security if you remain in a severe mishap (cars). Most professionals advise maintaining sufficient insurance coverage to shield your properties.

Sirijit Jongcharoenkulchai/ Eye, Em, Getty Images Just how much you need to spend for cars and truck insurance coverage differs commonly based on a range of aspects. Location is typically one of the most vital aspect for risk-free motorists with decent credit history, so it assists to recognize your state's standards (insured car). The nationwide standard for cars and truck insurance policy costs has to do with $1621 annually, and also there are states with standards far from that figure in both directions.

risks auto auto insurance cheapest

risks auto auto insurance cheapest

insurance affordable auto insurance car insurance vehicle insurance

insurance affordable auto insurance car insurance vehicle insurance

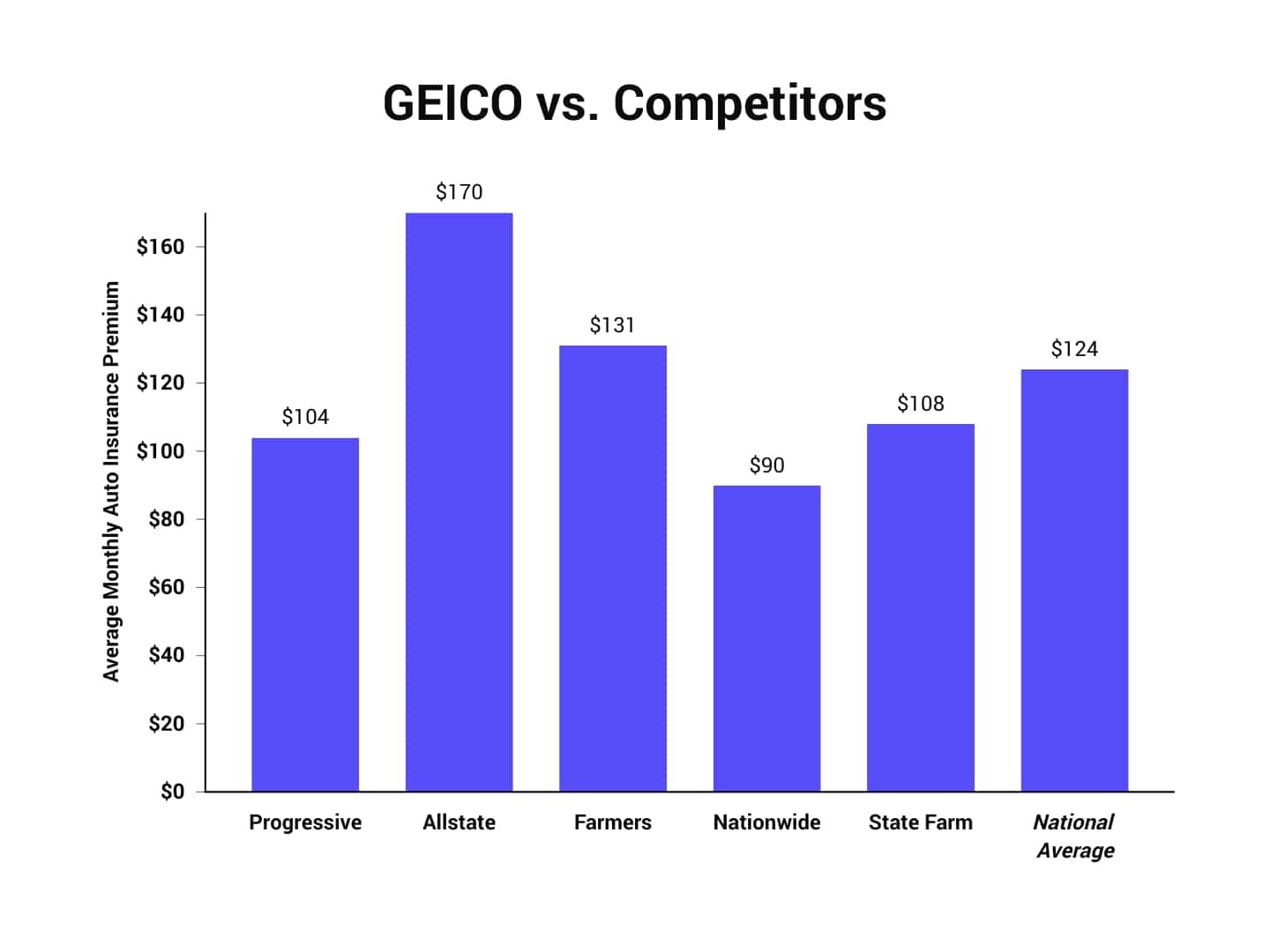

Typical National Prices, The total national average price of vehicle insurance policy will certainly vary based on the resource - trucks. Whatever the situation may be, you'll most likely find on your own paying more than $100 per month for automobile insurance (auto).

When computing national prices, a selection of variables are included. Besides, a number of coverage choices are offered from insurance provider, as well as the typical number needs to show one of the most usual kind of insurance coverage (car insurance). In this situation, the national price figures determine plans that include liability, extensive, as well as crash insurance coverage in addition to state-mandated insurance coverage like accident security as well as without insurance driver protection.

Usually, the minimum insurance policy will certainly cost concerning $676 per year, which is almost $1000 much less than the nationwide average per year (money). While these averages can be helpful for getting a suggestion of what insurance costs, your personal variables have the many impact on the costs rates you'll get. Ordinary Protection Level, Typically, people often tend to opt for even more protection than the minimum that's legally required.

The Greatest Guide To Average Car Insurance Cost (May 2022) - Wallethub

On standard, complete coverage will set you back not even $900 per year. The most expensive state for insurance is Michigan, and also its ordinary premiums are far past the nationwide standard.

Aspects Affecting Your Premiums, Just how much you ought to be paying for your premiums is mostly impacted by varying individual consider enhancement to your certain area. risks. While any kind of element can show just how much of a risk you will certainly be to insure as a vehicle driver, the most vital aspects are generally the exact same throughout all insurance coverage business, though there are exceptions (auto insurance).

Minimum state-required protection will certainly constantly be the most budget friendly, but if you intend on offering Informative post your car at a later date, detailed protection might be an individual need. Age: Age plays a large role in how much your costs is. If you more than the age of 25 with a tidy background, your premiums will mainly coincide for decades.

Teens are especially expensive to cover, as they pose one of the most risk due to their lack of experience. Time when driving: The even more time you invest in the roadway, the greater your premiums are going to be. This is due to the sheer chance of getting in a mishap being raised compared to people that do not drive as much (accident).

This is just true if you choose for extensive and crash insurance coverage. Considered that most individuals prepare to market higher-end designs in the future, nonetheless, extensive and also crash insurance coverage might be a requirement - affordable auto insurance. Credit rating rating: Your credit report suggests exactly how dependable you are when it comes to repaying lendings.

What Does What Are Car Insurance Premiums? [2022 Guide] - Marketwatch Mean?

cheaper cars accident low cost auto auto

cheaper cars accident low cost auto auto

Some states, nonetheless, ban companies from using credit report as a factor for premium prices. How much you ought to pay for vehicle insurance depends upon numerous aspects all interacting - insurance company. As a result of this, there is no one-size-fits-all response to your auto insurance policy needs. Keep in mind to shop about and also contrast quotes so that you can find the very best rates for the protection your specific driving routines ask for.

You may have the ability to find even more information regarding this and also similar material at.