states and the Area of Columbia. The company offers a vast array of insurance coverage and by 2016 was the second-largest insurance company in the U.S., defeating companies like Allstate - cheap car. What Are the Advantages of Guaranteeing With GEICO? According to Value, Penguin, the advantages of acquiring insurance policy from GEICO include: Its rates are relatively Visit the website cost effective.

In enhancement to moring than 50, you need to meet these demands to get approved for the Prime Time Contract: Your policy must not have vehicle drivers under 25 years old. low cost. You need to be free of accidents or offenses for the previous 3 years. Your plan should not have vehicles used for business.

Also people that are not GEICO policyholders can utilize this service to contrast car prices. car insured. What Car Insurance Coverage Coverages Does GEICO Offer? GEICO's insurance coverages resemble those of other major insurance firms, as well as they consist of: Physical injury and also property obligation insurance coverage, Collision and comprehensive coverageSpace Insurance coverage for leased lorries, Medical payment and injury protection coverage, Mechanical breakdown insurance policy, or else called cars and truck repair work insurance policy, which you can just contribute to autos much less than 15 months old that have fewer than 15,000 miles on the odometer, Ride-share insurance coverage, which covers you while driving for work or pleasure, Emergency roadway solution, which covers the price of jump-starts, towing, locksmith services, and also flat-tire changes, to name a few, Crash forgiveness, which suggests the insurance company will not hike your costs after one at-fault crash Glass coverage, which permits you to submit extensive insurance claims for glass repairs for an economical cost, Rental compensation, which covers the price of a rental vehicle if your lorry is out of solution for over 24 hr, Auto insurance costs differ relying on where you live, what vehicle you drive, your driving habits, as well as various other factors, so call a GEICO supplier to obtain an accurate quote.

This content is created as well as preserved by a 3rd party, and imported onto this web page to help customers supply their email addresses. You might have the ability to discover more details regarding this and similar material at.

Fascination About Nsu Alumni Insurance/financial Benefits

A remarkable instance is the Prime-time television Agreement, which GEICO honors to drivers over 50 years old in select states, including Alabama, Alaska, Iowa, Maryland, Minnesota, New Mexico, Ohio, Oregon, Tennessee, and extra. Motorists with Prime, Time can renew their policy as long as no drivers under the age of 25 requirement to be on the plan. cheaper cars.

GEICO stays one of the least expensive alternatives after an accident because the firm supplies an "crash forgiveness" alternative. The Zebra data programs that after a mishap, motorists with GEICO can expect annual premiums to raise from $1,276 generally to $1,997 in the initial year, $2,719 in the 2nd year, and also $3,441 in the third (credit).

, chauffeurs throughout all insurers in all various other states can anticipate their rates to be 115% greater if they have a poor credit scores score contrasted with a person with an outstanding credit background. On the whole, GEICO's client satisfaction has actually been rated higher than standard.

According to the J.D. Power 2021 United State Automobile Insurance Coverage Study, GEICO can be found in 12th of 25 national insurance providers for customer fulfillment. When it concerns monetary information, GEICO was given a premium ranking by AM Best, showing that its capacity to pay out its insurance claims is amongst the very best in the industry.

The Ultimate Guide To Car Insurance - Start A Free Auto Insurance Quote - Geico

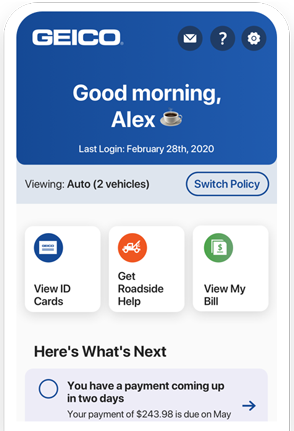

While originally created to guarantee government and also armed forces employees, the business currently provides cars and truck insurance coverage to all motorists throughout 50 states. The company obtains high marks for its client service as well as a range of services - insure. What makes it stand out is its mobile app and online solutions, which obtained the highest possible ranking in the Dynatrace Q1 2019 Mobile Insurance Coverage Scorecard.

Geico as well as Progressive are 2 of the biggest car insurance firms in the united state however which is much better? In this Geico vs. Progressive contrast, we at the House Media reviews group will see exactly how the suppliers accumulate in regards to cost, coverage options, client reviews and also even more. Keep in mind, these aren't the only high-quality insurance providers on the marketplace.

Comparing Geico as well as Progressive In our industry-wide review, we rated Geico and also Progressive similarly overall both were high on our list of the best car insurance policy suppliers. Here's a photo of Geico vs. Progressive: Geico has some of the least expensive rates nationwide.

Geico likewise has among the most basic on-line signup processes. Dynamic, like Geico, is a monetarily secure company with a good customer care reputation, as shown by its scores from AM Ideal and also the BBB. Unlike Geico, Progressive works through a network of independent insurance policy representatives. We acknowledged Progressive for having Low Prices for High-Risk Drivers due to the discounts it offers for young vehicle drivers, senior motorists and also drivers with a current DUI on record.

The Only Guide for Geico Auto Insurance Review - Policygenius [Updated 2022]

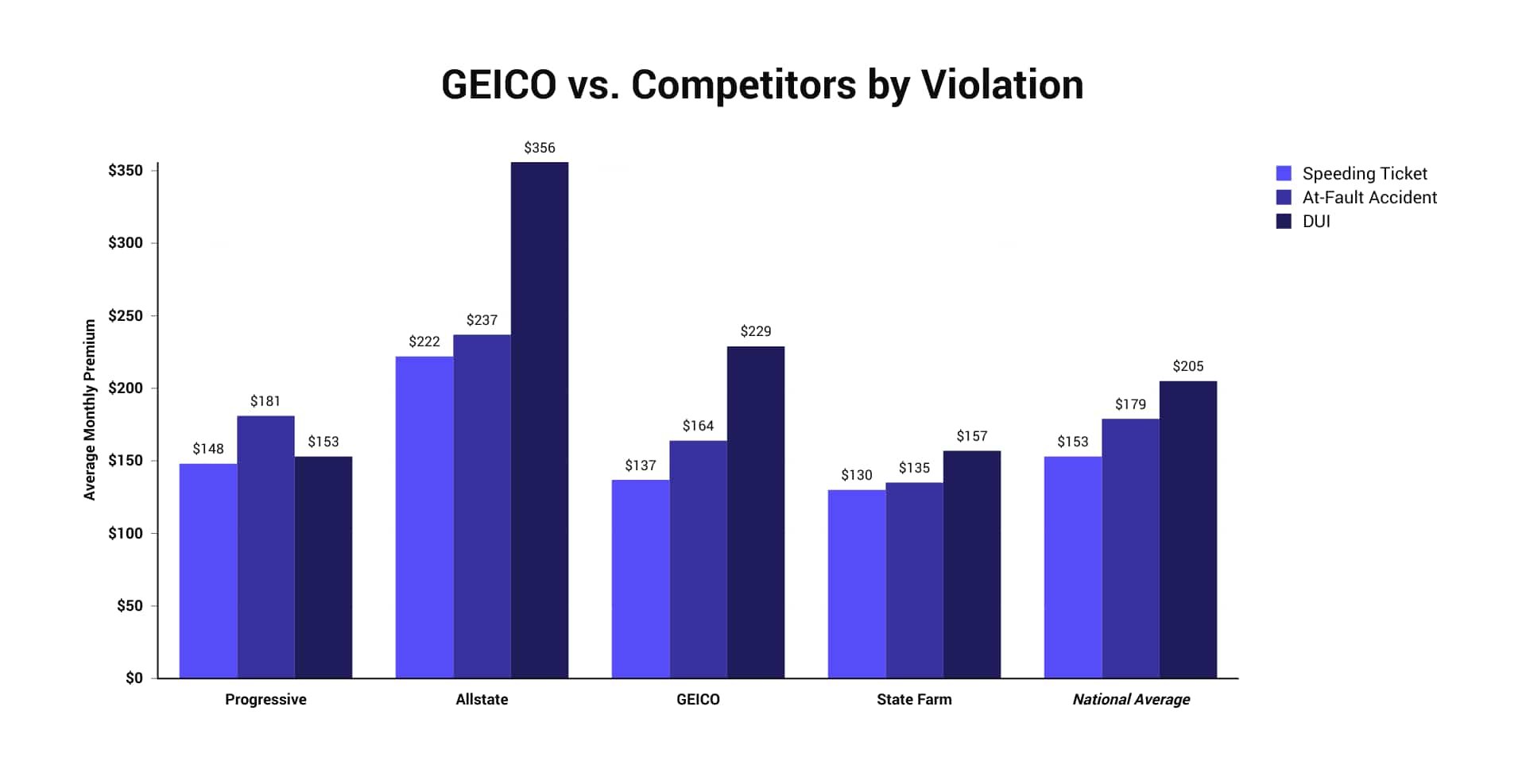

Progressive rates Both Geico and also Progressive offer inexpensive vehicle insurance policy to chauffeurs throughout the country. Geico's prices are generally reduced total, however Progressive has a tendency to supply much better prices to those with a recent DUI, at-fault crash or speeding ticket on their driving record. Naturally, expenses vary by driver, as well as your rates are identified by a number of variables, consisting of: Age Driving background Marriage status State City Lorry Plan restricts Credit history (in some states) The only means to learn which supplier will be more affordable for you is to connect for quotes from both.

Responsibility insurance policy is called for in most states. Crash: Crash insurance coverage covers repair service costs for your own automobile after a mishap or if your automobile flips. Crashes with pets are not covered by this insurance coverage. Comprehensive: Comprehensive insurance spends for repair prices if your vehicle is harmed by pets, all-natural calamities or fire.

Medical payments (Medication, Pay): This protection pays for your clinical costs and the clinical expenses of your guests after a crash. Accident defense (PIP): This coverage pays for medical costs for you and your guests, in addition to pain and enduring problems and also compensation for lost wages if you can not work due to accident-related injuries.

Uninsured/underinsured motorist (UM/UIM): Without insurance vehicle driver insurance coverage pays for your property as well as injury costs if you are entailed in a hit-and-run (cheaper car). It also covers crashes with motorists that do not have insurance coverage or do not have high sufficient plan limitations to cover the full cost of your problems. UM is required in some states.

The 7-Minute Rule for Does Geico Car Insurance Cover Rental Cars? - Autoslash

0-star consumer ranking as well as just under 3,000 grievances submitted in the last three years. This number of complaints may appear high, however it represents a small portion of clients when you take into consideration the truth that Geico is the second-largest cars and truck insurance policy company in the U.S. and also Progressive is the third-largest, according to the National Association of Insurance Commissioners (NAIC) (vehicle).

Geico tends to supply reduced rates for a lot of insurance policy holders and also has a little higher customer fulfillment ratings, while Progressive has wonderful options for high-risk drivers and more extensively readily available usage-based insurance policy. On the whole, below's just how we rate Geico vs. Progressive: Other suggestions for vehicle insurance Geico as well as Progressive aren't your just excellent options for inexpensive vehicle insurance.

We recommend State Farm for trainee vehicle drivers based upon its discount rate offerings. The Drive Safe & Save, TM as well as Steer Clear programs both help young drivers minimize insurance coverage costs. Naturally, State Farm isn't only for young motorists. affordable car insurance. It is the largest insurer in the nation according to the NAIC and has an A++ financial stamina score from AM Ideal.

Power U.S. cheaper car. Automobile Insurance Policy Fulfillment Research. To be eligible for an automobile insurance coverage plan with USAA, you should be a participant of the army or have a family members member who is a USAA member.

Animals (Rats) Or Vandalism To Front Bumper Lip?! Geico ... for Beginners

vehicle insurance cheaper car auto insurance cheapest

cheaper insure cheapest insure

cheaper insure cheapest insure

Our approach Due to the fact that consumers count on us to offer unbiased as well as exact info, we created an extensive score system to formulate our rankings of the best vehicle insurer - insurance company. We accumulated information on lots of car insurance coverage suppliers to grade the firms on a large range of ranking elements. Completion result was a general ranking for each and every provider, with the insurance firms that scored one of the most points topping the checklist.

money insurance affordable liability insurance companies

money insurance affordable liability insurance companies

Coverage (20% of total rating): Companies that offer a variety of choices for insurance policy protection are much more most likely to meet consumer requirements. Credibility (20% of overall score): Our research group considered market share, rankings from market specialists as well as years in service when giving this rating. vehicle insurance. Schedule (20% of complete rating): Automobile insurance firms with greater state accessibility and couple of qualification demands racked up highest possible in this group.

Geico (a phrase for Federal government Employees Insurance Provider) is the second-largest automobile insurance provider in the U.S. There are thousands of Geico insurance evaluates uploaded online. Yet is Geico a reputable insurer? We found that it is dependable as well as cost effective, though it may not be the most effective alternative for each driver.

Discover why in this post, where we take an appearance at Geico car insurance coverage choices, prices, rewards, and examines from insurance holders. Geico Auto Insurance Coverage Rating: 4. The insurance company's affordable rates and simple cases process make it a wise choice for a lot of motorists.

The Best Guide To The Geico Gecko (@Thegeicogecko) • Instagram Photos And ...

We additionally checked 1,000 automobile insurance policy customers on a variety of topics. Most states permit cars and truck insurance companies to make use of credit rating profiles in determining prices.

What you spend for vehicle insurance from Geico relies on your place. Drivers in some states may pay just $1,000 each year, while others can pay $2,000 or more for full protection insurance coverage based upon location alone. Below's a review of Geico's insurance policy expenses by state, together with each state's typical according to our price quotes - prices.

low cost accident vehicle insurance

low cost accident vehicle insurance

It consists of jump-starts, spare tire installation, lugging to a repair work store, as well as lockout solutions approximately $100 (low-cost auto insurance). Rental vehicle compensation This protection spends for the expenses of a rental car while your automobile is being fixed after a covered case. Geico deals with Venture Rent-A-Car, which suggests your insurance coverage will pay Business directly.

In the J.D. Power 2021 U.S. Automobile Insurance Coverage Study, SM, Geico earned a satisfaction position over the regional average in California and the Central and New England regions. There are lots of positive Geico insurance coverage reviews on sites consisting of Trustpilot and the BBB. On the BBB web site, Geico has an A+ ranking, showing that it quickly responds to client grievances.

Cost Of Cars Reddit. "Net Income Of $2. You Might Have A ... Fundamentals Explained

cheap car insurance laws insurance companies insurance affordable

cheap car insurance laws insurance companies insurance affordable

This put Geico in the leading five companies by contentment degree. In positive Geico insurance assesses, consumers applaud the simplicity of interaction with the business's representatives. No responsive price walks after cases.

I would certainly recommend this firm." Mark C. using BBB "I have been with this insurance coverage firm for [nine] years now, and they have always been so terrific to collaborate with! They help every single time I call and also are always so friendly. I am honored to call them my insurer. When I remained in my very first mishap, they made the whole process so simple and also got me into a rental within the next company day." C.J. You may conserve money with Geico, yet you squander a great deal of time. I reacted to an outrageous failure quantity for my vehicle (barely half of what I paid for [the] car and also not even half of what [it was] valued at) at 11:00 AM and also was told that he would assess everything on Tuesday.